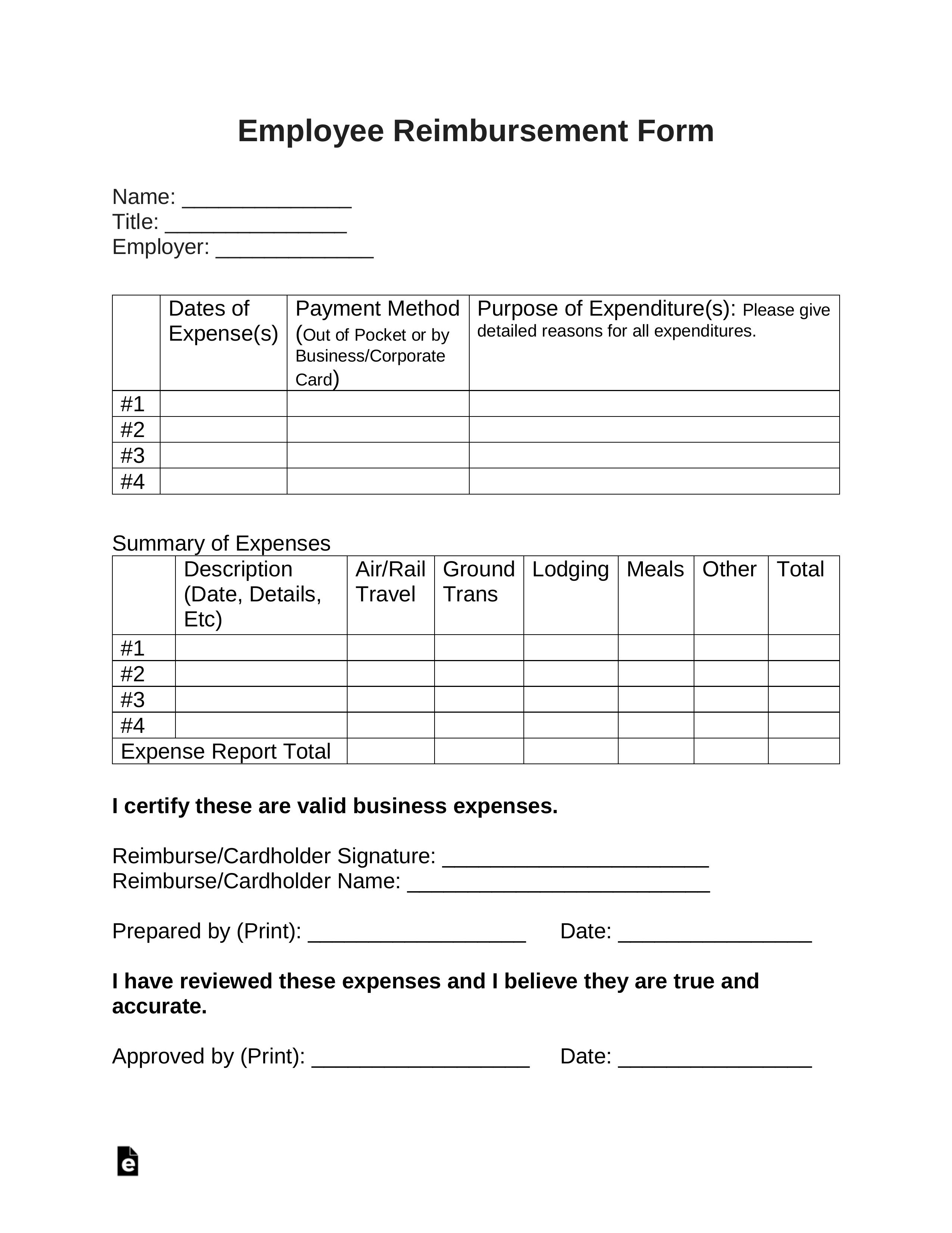

Compliance with Financial Conflict of Interest Requirements in Research.Code of Workplace Conduct for Trademark Licenses.Questions about the content of this policy should be directed to the Controller’s Office at 41Ĭarnegie Mellon will pay for or reimburse university business and travel expenses that comply with this Policy.

Office of the Vice President for Finance and Chief Financial Officer. This Policy supersedes the 2011 Business and Travel Expense Policy. Administrative changes were made on February 21, 2022. This Policy was approved by the President on Septemand applies to all business and travel expenses incurred and/or expense reports submitted on or after October 1, 2018. Business and Travel Expense Policy POLICY TITLE:Ĭarnegie Mellon University Business and Travel Expense Policy

0 kommentar(er)

0 kommentar(er)